Financial Solutions: Loan Applications

Advertisement advertisements

The loan applications offer a fast and convenient way to access financing from the comfort of your home.

These applications are designed to simplify the loan application and approval process, allowing you to get the money you need in a matter of minutes.

In this article, we will explore the best loan applications available and how they can benefit you.

Benefits of Using a Loan Application

Loan applications have gained popularity due to the convenience and accessibility they offer.

The following are the main benefits of using these platforms:

Quick Access to MoneyOne of the biggest advantages of loan applications is the speed with which you can get the money you need.

Many applications offer instant approvals and funds transfers within minutes, which is ideal for financial emergencies.

Convenience and Ease of UseLoan applications eliminate the need to visit banks or complete extensive paperwork.

You can apply for a loan from the comfort of your home using your cell phone or tablet, at any time of the day.

Transparency in ConditionsThese applications usually provide clear terms and conditions, including interest rates, payment terms and any additional fees.

This allows users to make informed decisions before committing to a loan.

Access for Persons with No Credit HistoryUnlike traditional banks, many loan applications do not require an extensive credit history.

They will evaluate other factors, such as your income and financial behavior, to determine your eligibility.

Flexible Payment TermsMany applications offer flexible payment options, allowing users to choose terms that suit their financial capabilities.

This helps reduce financial stress and facilitates debt management.

Variety of Financial ProductsIn addition to personal loans, some applications also offer lines of credit, small business loans and other financing options.

This allows users to find the financial solution that best suits their needs.

Real-Time Loan ManagementLoan applications allow users to manage their loans in real time.

You can make payments, view your outstanding balance and monitor your payment history directly from the application.

Financial EducationSome loan applications offer educational resources and tools to help users improve their financial health.

This includes advice on how to manage debt, improve your credit score and plan your budget.

Lower Barriers to EntryLoan applications tend to have fewer requirements and barriers to entry compared to traditional banks.

This facilitates access to financing for a larger number of people.

Innovation and TechnologyLoan applications use advanced technology to simplify and improve the loan application and management process.

This includes the use of algorithms to assess credit risk and offer customized financial products.

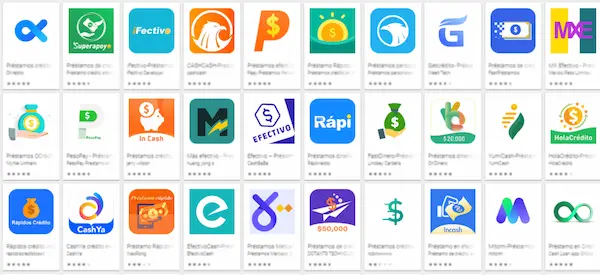

Best Loan Applications on the Market

Kueski

Kueski is one of the most popular lending applications in Mexico.

It offers short-term personal loans with a quick and easy application process.

The application is designed for users who need immediate access to cash for emergencies or unforeseen expenses.

Advantages:

- Process of approval in minutes.

- Does not require credit history.

- Availability 24/7.

Disadvantages:

- Higher interest rates due to the short-term nature of the loans.

- Relatively low loan limits.

Creditea

Creditea is an application that offers flexible credit lines and personal loans.

It is ideal for those looking for a more structured financing solution with fixed monthly payments.

Advantages:

- Lines of revolving credit.

- Interest rates competitive.

- Deadlines for flexible payment.

Disadvantages:

- Requires a more detailed credit check.

- You may be charged for late payments.

Tala

Tala is a lending application that operates in several countries, including Mexico and the Philippines.

It focuses on providing access to financing for people who are unbanked or have limited access to traditional financial services.

Advantages:

- Accessible for people no credit history.

- Application Process fast and easy.

- Integrated financial education in the application.

Disadvantages:

- Relatively high interest rates.

- Low initial loan amounts.

Yotepresto

Yotepresto is a peer-to-peer (P2P) lending platform that connects borrowers with investors.

It offers personal loans with competitive interest rates based on the applicant's credit profile.

Advantages:

- Rates of lower interest thanks to the P2P model.

- Transparency in the application and approval process.

- Options for flexible payment.

Disadvantages:

- Requires a good credit history to obtain the best rates.

- More detailed verification process.

MoneyMan

MoneyMan is an application that offers fast short-term loans with a focus on simplicity and speed of the application process.

It is ideal for those who need immediate access to funds.

Advantages:

- Application Process online fast and easy.

- No history required credit.

- Approvals and disbursements fast.

Disadvantages:

Higher interest rates due to the short-term nature of the loans.

Relatively low loan limits.

What is a Loan Application?

A loan application is a digital platform that allows users to apply for and obtain loans directly from their mobile devices.

These applications eliminate the need to visit banks or financial institutions, making the process faster and more accessible.

Loan applications typically offer a variety of financial products, from personal loans to lines of credit and small business financing.

Frequently Asked Questions about Loan Applications

1. Can I get a loan if I have no credit history?

Yes, many loan applications are designed for people with no credit history. They evaluate other factors, such as your income and financial behavior.

2. How long does it take to get approved for a loan?

Approval time varies by application, but many offer approvals within minutes.

What is the maximum amount I can borrow?

The maximum amount depends on the application and your financial profile. Some applications offer higher amounts for users with good credit history.

4. What if I cannot pay on time?

It is important to read the terms and conditions of each application. Some may charge late fees or increase interest rates.

5. Are loan applications safe?

Most lending applications use advanced security technologies to protect your personal and financial data.

However, it is always advisable to research and read reviews before using a new application.

Important Considerations

While lending applications offer numerous benefits, it is also important to use them with caution.

Users should make sure they fully understand the terms and conditions, including interest rates and possible penalties for late payments.

It is essential to assess repayment capacity before applying for a loan to avoid falling into a cycle of debt.

Our Opinion on Loan Applications

Loan applications have transformed access to financing, providing a fast and convenient solution for a variety of financial needs.

Here are some considerations as to why we believe these applications are a valuable option for users:

Immediate AccessibilityLoan applications offer unprecedented accessibility.

It is no longer necessary to visit a bank branch or wait days for a loan approval.

With a few clicks on your mobile device, you can get the money you need almost instantly.

Simplification of the Application ProcessThe digitization of the loan application process has greatly simplified this process.

The forms are easy to complete and the documentation required is minimal, reducing complexity and waiting time.

Flexibility and CustomizationLoan applications are designed to be flexible, allowing users to select repayment terms that fit their financial situation.

In addition, the advanced algorithms used by these platforms can offer customized financial products based on the user's profile.

Access for AllMany of these applications are designed to be inclusive, providing access to financing even for those with no or limited credit history.

This is especially valuable in regions where traditional financial services are not readily available.

Transparency and Financial EducationLoan applications are often transparent about their interest rates and terms, allowing users to make informed decisions.

In addition, some applications offer educational resources to help users improve their financial health and make better decisions.

Important Considerations Financial Solutions

While lending applications offer numerous benefits, it is also important to use them with caution.

Users should make sure they fully understand the terms and conditions, including interest rates and possible penalties for late payments.

It is essential to assess repayment capacity before applying for a loan to avoid falling into a cycle of debt.

In our opinion, loan applications represent a powerful tool for those who need quick and convenient access to financing.

Their ability to provide customized financial solutions and their ease of use make them an attractive option for a wide range of users.

However, as with any financial product, it is crucial to use them responsibly and to be well informed about the terms and conditions.

In short, lending applications have democratized access to credit, offering a viable and modern alternative to traditional methods.

They are an option worth considering for those seeking quick and efficient financial solutions, as long as they are used responsibly and with full knowledge of their implications.